Ghost Tapping: The New Tap-to-Pay Scam You Need to Watch Out For

Tap-to-pay is supposed to make your life easier - quick checkout, no swiping, no inserting, no hassle. But with that convenience comes a new and growing scam called ghost tapping, and it’s catching a lot of people off guard.

At ID Stronghold, we follow security trends closely, and this is one scam you should know about. Here’s what ghost tapping is, how scammers pull it off, and what you can do to protect yourself.

What Is Ghost Tapping?

Ghost tapping is a technique scammers use to secretly charge your tap-enabled credit card or mobile wallet. All they need to do is get close enough with a small NFC reader, and your card can process a payment without you realizing it.

No swipe. No insert. No PIN. No obvious interaction. Just a quick, silent charge before you can react.

That’s what makes ghost tapping so dangerous — there’s no telltale sign the payment happened until you check your account.

How Scammers Use Ghost Tapping

Most ghost tapping setups are surprisingly simple:

-

Scammers carry portable payment readers that look like normal tap-to-pay devices.

-

They blend into crowded spaces like concerts, airports, subways, or festivals.

-

They may pose as charity workers or vendors, encouraging you to “just tap quickly.”

-

They often start with tiny “test” charges to see if your card is active.

-

They follow up with larger charges later, when you’re no longer nearby.

Since tap-to-pay doesn’t require physical contact, scammers only need to be within NFC range — sometimes just a couple of inches.

Why Ghost Tapping Works

Ghost tapping is effective because:

• It doesn’t require stolen cards

Your card stays in your wallet or pocket the entire time.

• Small charges go unnoticed

A $1.00 or $3.00 charge doesn’t always raise flags.

• Crowds create cover

It’s easy for someone to get close to your bag, purse, or wallet without standing out.

• Banks sometimes assume it's a legitimate tap

Because you “tapped” (even though you didn't), automated systems may not flag it right away.

How to Protect Yourself From Ghost Tapping

You don’t need to stop using tap-to-pay. You just need a few simple safeguards:

1. Use RFID-Blocking Protection

This is the fastest and most reliable way to stop ghost tapping.

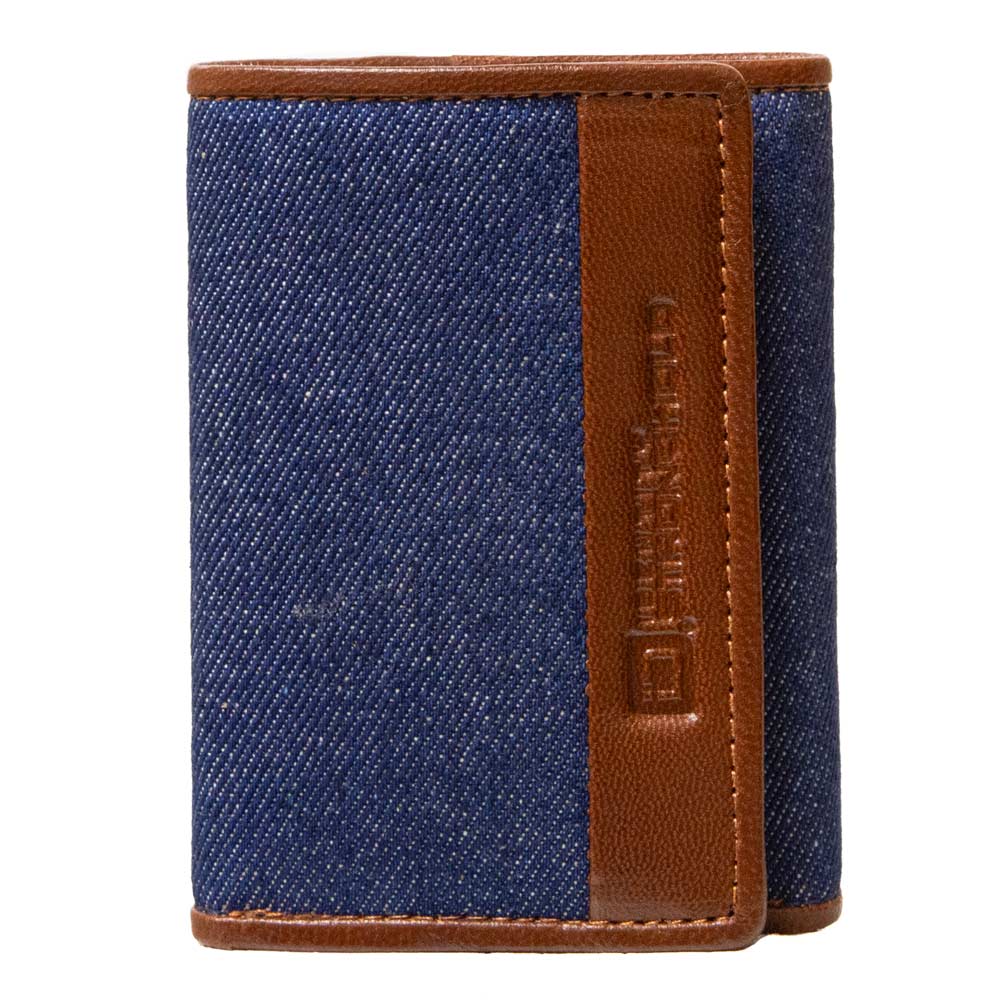

Our RFID-blocking wallets and sleeves are built to shield the NFC signal, so unauthorized readers can’t activate your card — period.

2. Double-check before you tap

Don’t tap an unfamiliar reader without quickly checking the amount and the merchant name.

3. Turn on purchase alerts

Most banks offer instant notifications when your card is used. These help you catch unauthorized charges right away.

4. Watch your statements

If you see even a small charge you don’t recognize, treat it seriously — it could be a test run.

5. Keep your phone locked

If you use a mobile wallet, make sure biometrics or a passcode is required before payment.

6. Avoid rushed taps

If someone is pushing you to tap fast, step back. Scammers rely on pressure and distraction.

Ghost Tapping Is Real - But It’s Also Preventable

Ghost tapping highlights a simple truth: as payments get easier, scammers get smarter. But protecting yourself doesn’t have to be complicated.

Every RFID-blocking wallet and sleeve we make at ID Stronghold is designed to stop unauthorized scans and shield your cards from the kind of wireless access ghost tappers rely on.

You likely already have these tap to pay card in your wallet, RFID protection gives you peace of mind without changing how you use your cards.